SAM, is an intellectual property designed for investors, big or small

We display to you how transparent cryptocurrency investment opportunities look like, all through the accumulation of mining cryptocurrencies, using tangible assets.

The Problem

Investors are faced with Crypto Currency investment schemes that they have:

- A lack of knowledge of

- Limited or 0% control over

- False sense of security

- Misrepresentation of expectations

- Nothing tangible to show for

FAQ

Education on Investment Considerations

So you have invested a lump-sum amount into your Cryptocurrency Mining hardware and you have generated an automated income stream. Now what?

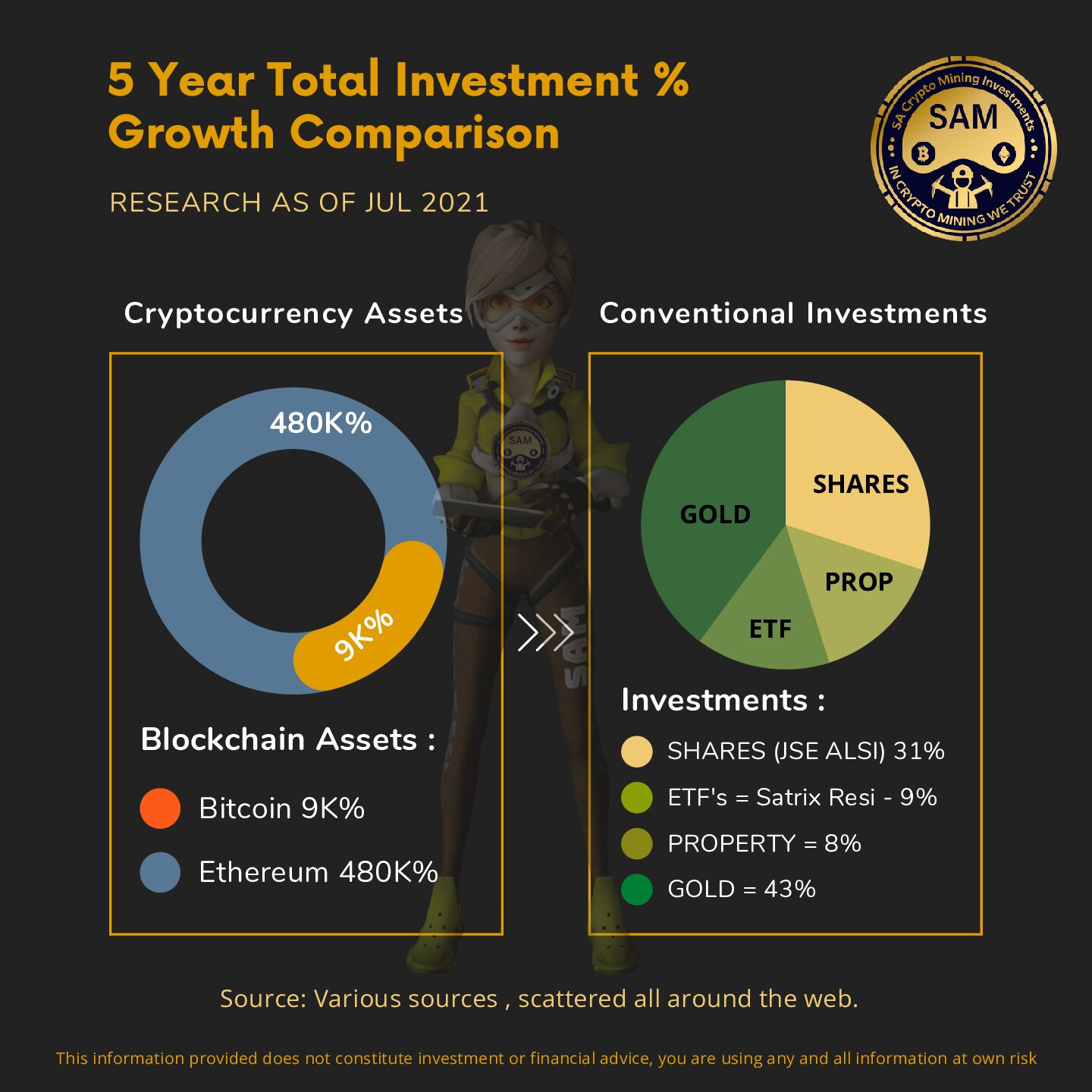

There are thousands of cryptocurrencies (assets on a blockchain network) being actively traded across hundreds of exchanges globally. Every Investor should know about the 5 types of metrics used to determine any blockchain asset’s value as well as the associated Risk, Reward, Cost and Profit factors.

No Trading Skill Required

As an Investor, accumulation of value holding assets could become worth more when exchanged for something else. It’s all excitement while you drive into the experience

Your Wealth, in Your Hands, thank SAM

As your mined Cryptocurrencies increase in value. so should your dreams. No Broker or Brokerage Fees. No Taxation Fees. Your Wealth, your Wallet, your Way

Bitcoin difficulty drops by over 11%, sharpest drop since 2021 China ban

The Bitcoin network’s mining difficulty dropped by as much as 27% within a single adjustment period during China’s Read More

What crashed Bitcoin? Three theories behind BTC’s trip below $60K

Hong Kong hedge funds’ leveraged BTC price bets are emerging as the main trigger behind Bitcoin’s sharp month-long sell-off. BiRead More

Tether helps Turkey seize $544M in crypto tied to illegal betting network

Tether claims it has helped law enforcement in over 1,800 cases across 62 countries, freezing $3.4 billion in USDT tied to suspRead More

Bitcoin to fill $84K futures gap ‘very soon’ as BTC rejects above 2021 top

Bitcoin market participants diverged on the short-term BTC price outlook, with warnings of new macro lows contrasting with $84,Read More

Vietnam to tax crypto like stocks with 0.1% trading levy: Report

Vietnam’s Finance Ministry proposes a 0.1% tax on crypto transfers, 20% corporate tax on profits and tough licensing standards Read More

$231.6M pours into IBIT following ‘second-worst’ day for ETF price

BlackRock’s Bitcoin ETF posted inflows on Friday following a turbulent week for Bitcoin, marking only its 11th day of net infloRead More